kentucky property tax calculator

If you are receiving the homestead exemption your assessment will be reduced by. The property values are determined by the Warren County.

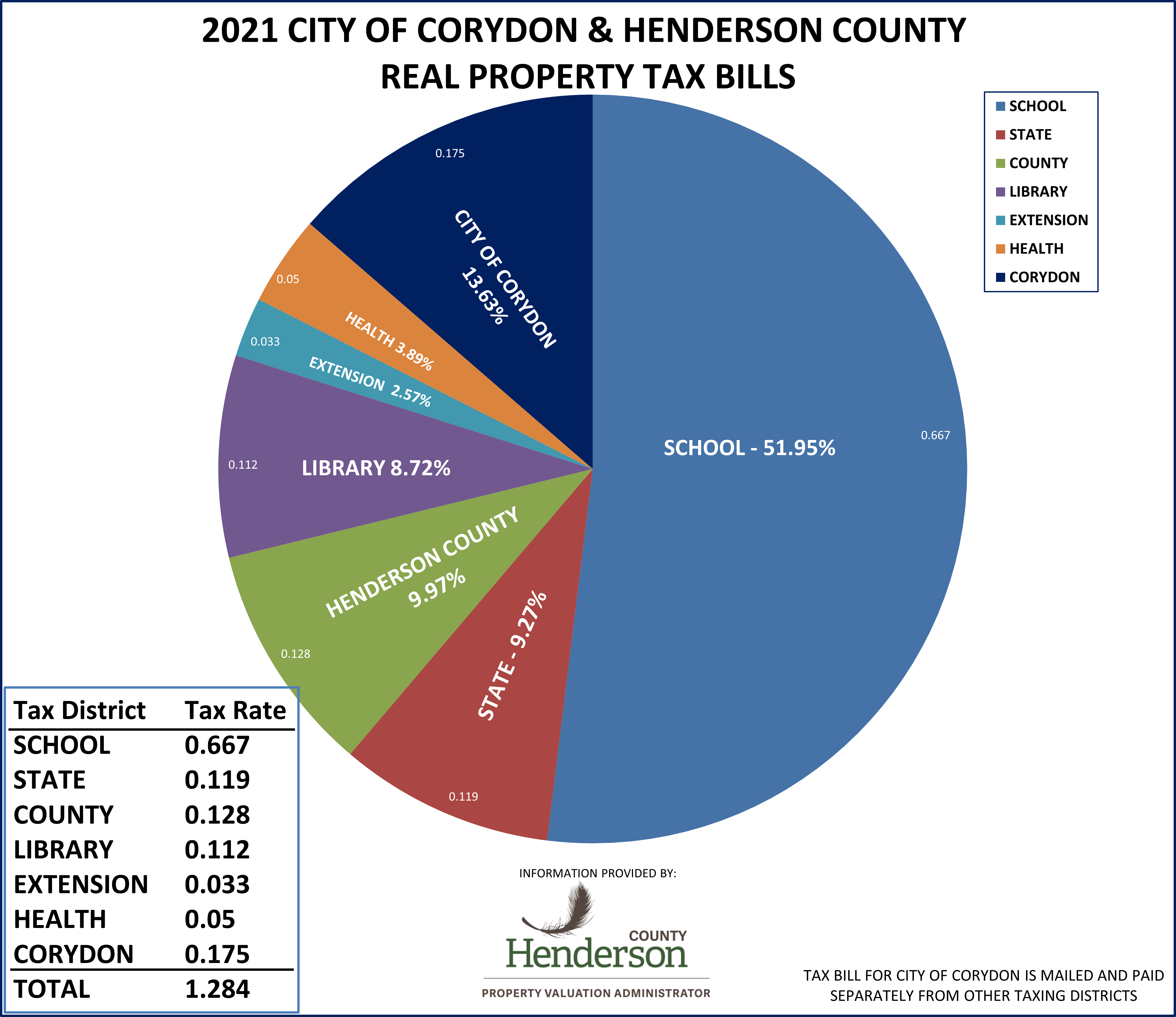

Tax Rates Henderson County Pva

Oldham County collects the highest property tax in Kentucky levying an average of 224400.

. At the same time cities and counties may impose their. The Kentucky Department of Revenue is required by the Commonwealth Constitution Section 172 to assess property tax at its fair cash value estimated at the price it. Maintaining list of all tangible personal property.

Meanwhile the states average outstanding mortgage amount is 126485. Property tax is calculated based on your home value and the property tax rate. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property.

Kentucky Property Tax Calculator to calculate the property tax for your home or investment asset. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202122. Delaware DE Transfer Tax.

The Office of the Warren County Sheriff as established in Kentucky law by KRS 134140 and 160500 is the collector of all state county school and district taxes derived. Kentucky has a flat income tax of 5. That is a 21915 difference between the average.

Therefore the DOR Inventory Tax Credit Calculator is the. For a more specific estimate find the calculator for your county. The median property tax on a 14590000 house is 105048 in Kentucky The median property tax on a 14590000 house is 153195 in the United States Remember.

Overview of Kentucky Taxes. In fact the typical homeowner in Kentucky pays just 1257 each year in property taxes which is much less than the 2578 national median. Well try to find your propertys assessed value for you.

That rate ranks slightly below the national average. The Property Valuation Administrators office is responsible for. For example the sale of a.

Enter your street address and click. The median property tax on a 11780000 house is 84816 in Kentucky. This calculator will determine your tax amount by selecting the tax district and amount.

A 2 discount is available if the bill is paid by November 30th. All rates are per 100. Tax bills are due by December 31st.

In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components. Please note that this is an estimated amount. The State of Delaware transfer tax rate is 250.

This estimator is based on median property tax values in all of Kentuckys counties which can vary widely. Our calculator has recently been updated to include both the latest Federal Tax. Actual amounts are subject to change based on tax rate changes.

Property taxes paid after December. The median property tax on a 10770000 house is 113085 in the United States. A short-term capital gain is taxed as ordinary income and long-term capital gains are taxed at rates of 0 15 20.

Find Your Propertys Assessed Value. Russell County collects on average 066 of a propertys assessed. Property tax bills are mailed in October of each year.

The states average effective property tax rate annual tax payments as a percentage of home value is also low at 083. Property taxes in Kentucky are relatively low. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the KY property tax calculator.

The Treasury office collects property taxes for the City itself and also for the Bowling Green Independent School System. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. The exact property tax levied depends on the county in Kentucky the property is located in.

The median property tax on a 10770000 house is 77544 in Kentucky. Kentuckys median house value is 148400. All property that is not.

Property not exempted has to be taxed equally and consistently at present-day. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of. The median property tax on a 11780000 house is 123690 in the United States.

The median property tax in Russell County Kentucky is 536 per year for a home worth the median value of 81400. A short-term assist is anything owned for one year or less. A citys real estate tax regulations should comply with Kentucky constitutional rules and regulations.

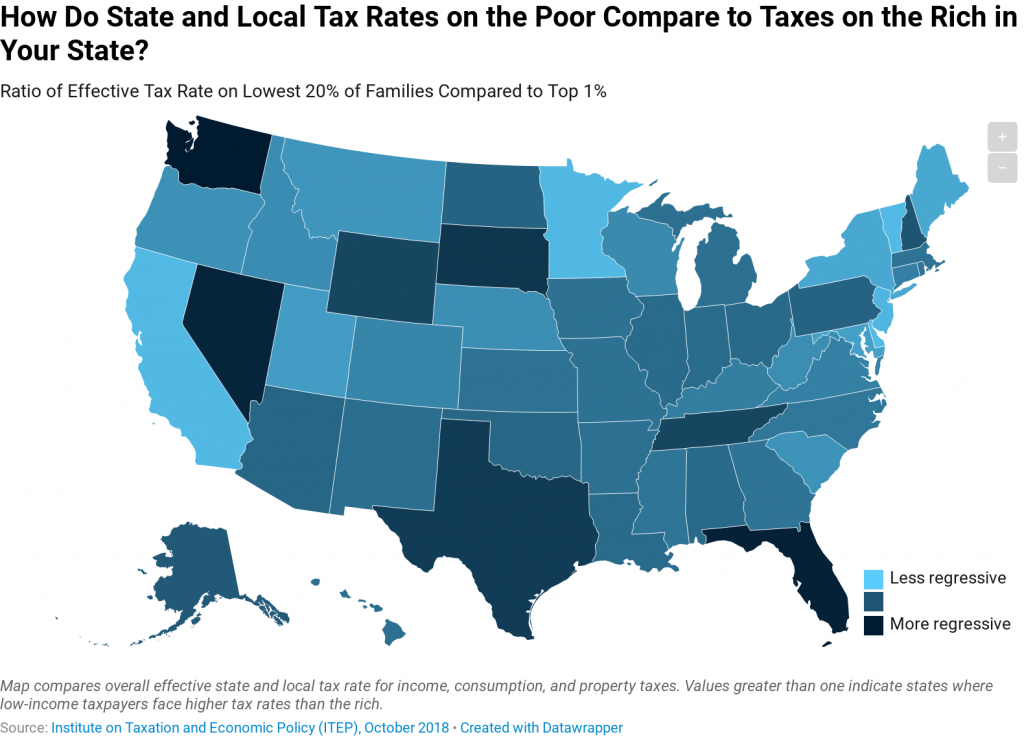

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

Property Tax Calculator Casaplorer

Kentucky Property Tax Calculator Smartasset

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville

States With Highest And Lowest Sales Tax Rates

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Kentucky League Of Cities Infocentral

Kentucky Property Tax Calculator Smartasset

Kentucky Property Taxes By County 2022

Kentucky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Jefferson County Ky Property Tax Calculator Smartasset

North Central Illinois Economic Development Corporation Property Taxes